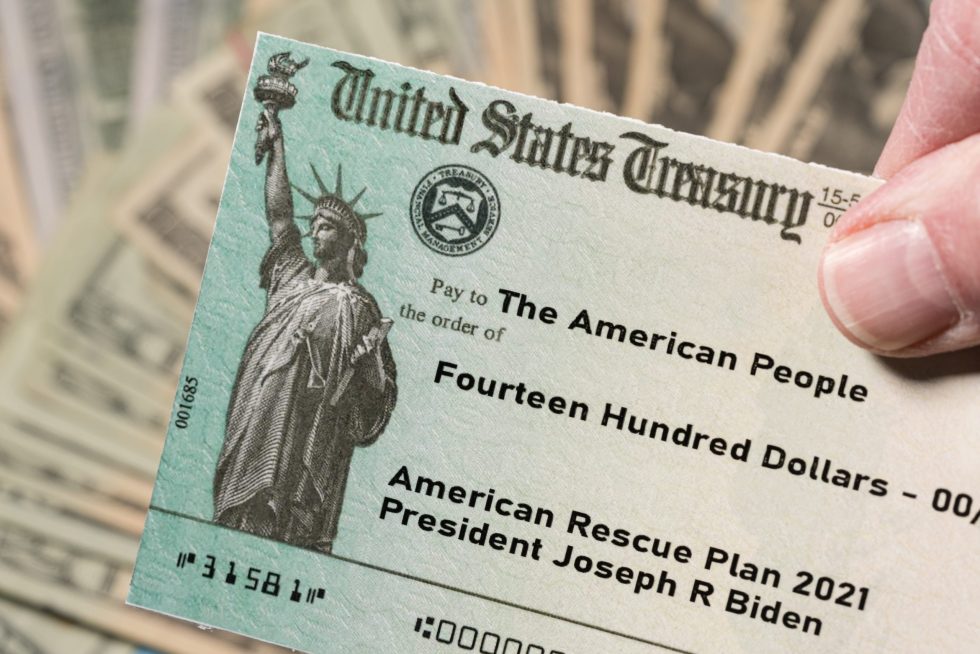

The American Rescue Plan, which was enacted on March 10, 2021, has far reaching effects on your taxes, both for tax year 2020 and 2021. In this post, we are focusing on the changes that affect your 2020 tax year return.

The American Rescue Plan excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you won’t have to pay tax on unemployment income of up to $10,200. Amounts over $10,200 are still taxable, and if your modified Adjusted Gross Income (AGI) is over $150,000, you can’t exclude any unemployment income.

If you filed your return before these changes went into effect, do not file an amended return. The IRS has stated that they will determine the correct amount of taxable unemployment compensation, and any overpayment of tax will either be refunded or applied to other outstanding taxes owed. This will happen in two phases. The first phase will be single taxpayers, then taxpayers who filed jointly. The refunds will be processed starting in May and will continue throughout the summer.

If, however, you expect this adjustment to your AGI to make you eligible for a tax credit or an increase of a tax credit previously claimed, you will need to file an amended tax return to claim those credits.

The American Rescue Plan also removes the requirement that excess Advance Premium Tax Credits be treated as an additional tax liability on the taxpayers tax return for 2020. In other words, you will not have to pay the excess Advance Premium Tax Credit back. If you have already filed your return and reported your repayment of the Advance Premium Tax Credit, the current guidance from the IRS is to wait – do not file an amended return until the IRS releases further guidance.